Convertible bonds, for instance, are valued using a blend of bond valuation methods and equity valuation techniques. The conversion option embedded in these bonds adds a layer of complexity, often requiring option pricing models like the Black-Scholes model to estimate the value of the conversion feature. Preferred shares with conversion options are similarly evaluated, with analysts considering both the fixed income component and the potential for equity conversion. The valuation of these instruments often involves scenario analysis to account for various market conditions and the likelihood of conversion.

Is there any other context you can provide?

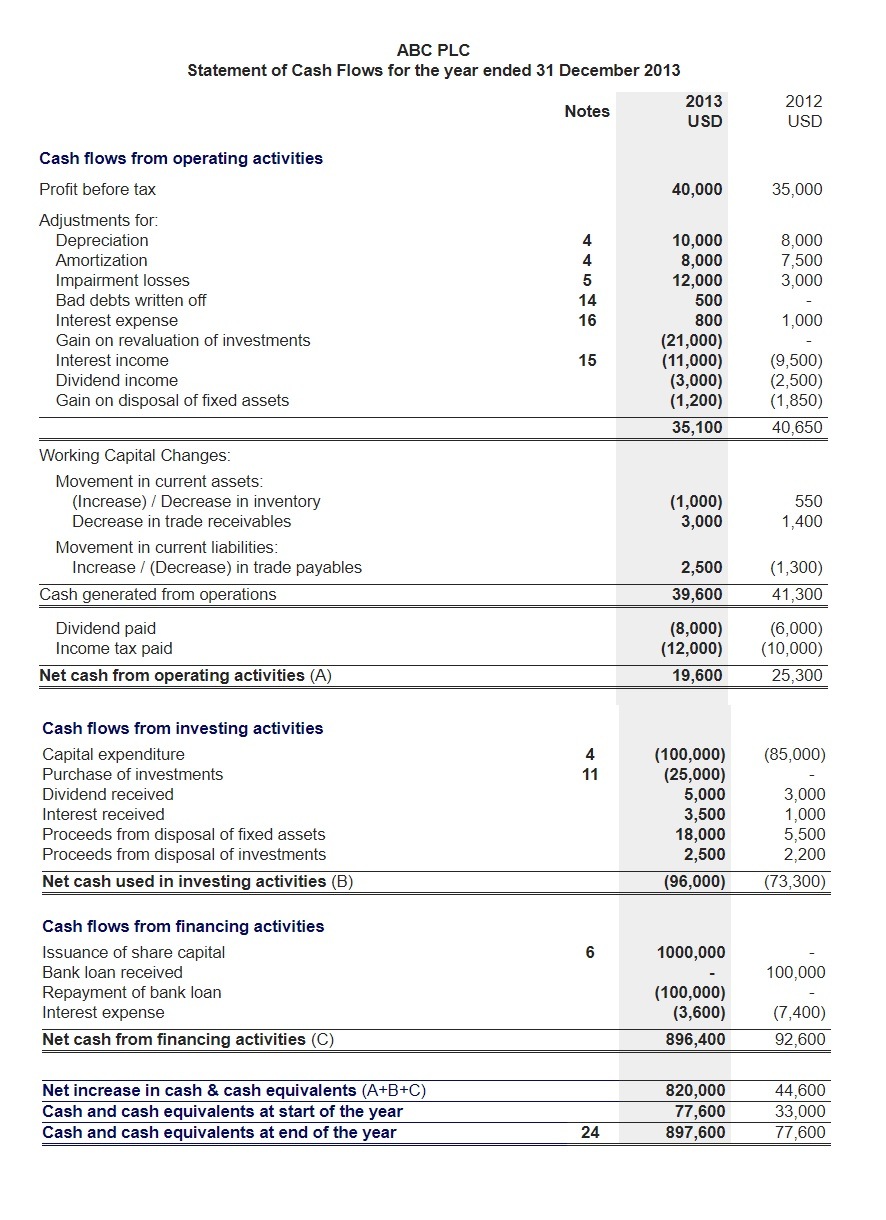

Cash flow from investing activities is a major component of the cash flow statement. The cash flow statement is one of the four annual financial statements prepared by companies at the end of the year. Airbnb’s quick assets include cash and cash equivalents, marketable securities, and funds receivable. Restricted cash, prepaids, and other assets are not easily converted into cash, so would not be used when calculating the quick ratio. Investors and corporations alike often turn to marketable securities as a means of managing liquidity, diversifying portfolios, and achieving short-term financial goals.

Impact of Marketable Securities

This section tends to be more qualitative than quantitative, shedding more light on the marketable securities that a company has on hand. The cash flow statement is reported in a straightforward manner, using cash payments and receipts. From this CFS, we can see that the net cash flow for the 2017 fiscal year was $1,522,000. The bulk of the positive cash flow stems from cash earned from operations, which is a good sign for investors. It means that core operations are generating business and that there is enough money to buy new inventory. Cash equivalents are interest-earning financial vehicles/investments that are widely traded, highly liquid, and easy to convert to cash.

Part 2: Your Current Nest Egg

- Explore the types, accounting methods, valuation techniques, and financial impacts of marketable securities in this comprehensive guide.

- It means that core operations are generating business and that there is enough money to buy new inventory.

- Marketable securities are short-term assets that can be sold quickly and converted into cash.

- All programs require the completion of a brief online enrollment form before payment.

The fact that CAPEX was nearly double this amount demonstrates that it is a growth firm. A firm can suffer from spending unwisely on acquisitions or CAPEX to either maintain or grow its operations. A guide for CAPEX is how it relates to depreciation and amortization, which can be found in cash flow from operations on the cash flow statement. This represents an annual charge on past spending that was capitalized on the balance sheet to grow and maintain the business. Immediately, you can observe that the main investing activities for Texas Roadhouse was CAPEX. Texas Roadhouse is growing briskly and spends plenty on CAPEX to open new restaurant locations across the United States.

These financial statements systematically present the financial performance of the company throughout the year. Marketable securities are defined as investments with short-term maturities that can be easily sold on public exchanges such as the Nasdaq and NYSE. Additionally, marketable securities can be more advantageous than cash since they may generate a positive return, though this is not always the case. Marketable securities are useful assets for a company to have if they need to raise funds quickly, such as for an acquisition opportunity or to meet a short-term obligation. Changes made in cash, accounts receivable, depreciation, inventory, and accounts payable are generally reflected in cash from operations.

Provides an Overview of Spending

This causes a disconnect between net income and actual cash flow because not all transactions in net income on the income statement involve actual cash items. Therefore, certain items must be reevaluated when calculating cash flow from operations. Cash from financing activities includes the sources of cash from investors and banks, as well as the way cash is paid to shareholders. This includes any dividends, payments for stock repurchases, and repayment of debt principal (loans) that are made by the company. By looking at the cash flow statement, one can see whether the company has sufficient cash flowing in to pay its debts, fund its operations, and return money to shareholders via dividends or stock buybacks. Marketable securities play a significant role in portfolio management, offering a blend of liquidity, diversification, and risk management.

So if you remain unsure about how liquid a company is, remember that the line items occur in order of liquidity or the ability to convert to cash quickly. All marketable securities are financial instruments bought and sold on public markets, bond exchanges, or stock exchanges. For example, Warren Buffett and Berkshire Hathaway hold most of their investments free construction service invoice template in equities or stocks and a smaller portion in short-term debt such as T-bills or bonds. Markel (MKL) also plays in this camp, the re-insurance company run by Tom Gayner. If, however, a company invests in another company’s equity in order to acquire or control that company, the securities aren’t considered marketable equity securities.

Convertible bonds, for example, can be converted into a predetermined number of shares, providing the potential for capital appreciation while offering fixed interest payments. Preferred stocks with debt-like features, such as cumulative dividends, also fall into this category. These instruments are designed to attract investors seeking a balance between income and growth. Companies use hybrid securities to diversify their financing options, potentially lowering their cost of capital and providing flexibility in financial planning. Solution – As discussed above, the classification of securities as marketable securities has to be judged based on two crucial features – Highly liquid and easily transferable. Classification of such securities is not based on the time duration for which the investors hold it.

However, instead of holding on to all the cash in its coffers which presents no opportunity to earn interest, a business will invest a portion of the cash in short-term liquid securities. If a sudden need for cash emerges, the company can easily liquidate these securities. Examples of a short-term investment products are a group of assets categorized as marketable securities. Consider a hypothetical company’s net annual cash flow from investing activities. For the year, the company spent $30 billion on capital expenditures, of which the majority were fixed assets.