It’s also important to point out that the purchase of PP&E (CapEx) has been fairly proportional to depreciation, which indicates the company is consistently reinvesting to keep its assets in good shape. Warren Buffett understands, better than most, the importance of capital returns on investments and the need to find greater and greater investments to generate those returns. Insurance companies earn much of their income from the premiums it collects and a substantial portion from their investment portfolios.

Unitization in Finance: Principles, Types, and Implications

Cash equivalents are not identical to cash in hand, though they have such low risk and high liquidity that they’re often considered as accessible. Companies may intentionally carry higher balances of cash equivalents so they can capitalize on business opportunities when they arise. Instead of locking capital into a long-term, illiquid, and maybe volatile investment, a company can choose to invest added cash in cash equivalents in the event it needs funds quickly. A certificate of deposit is a type of savings account with a financial institution. It represents a certain amount of a saver’s capital that can’t be accessed by the saver for a specific period of time.

Example from Amazon’s Balance Sheet

Commercial paper is a short-term, unsecured promissory note issued by corporations. Debt securities are generally less risky than equity securities and provide regular income, making them attractive for conservative investors. They also play a crucial role in a company’s capital structure, affecting its leverage and interest obligations. Trading securities are bought and held primarily for short-term profit from market price fluctuations. These are recorded at fair value on the balance sheet, with unrealized gains and losses recognized in the income statement.

Accounting for Intercorporate Investments: What You Need to Know

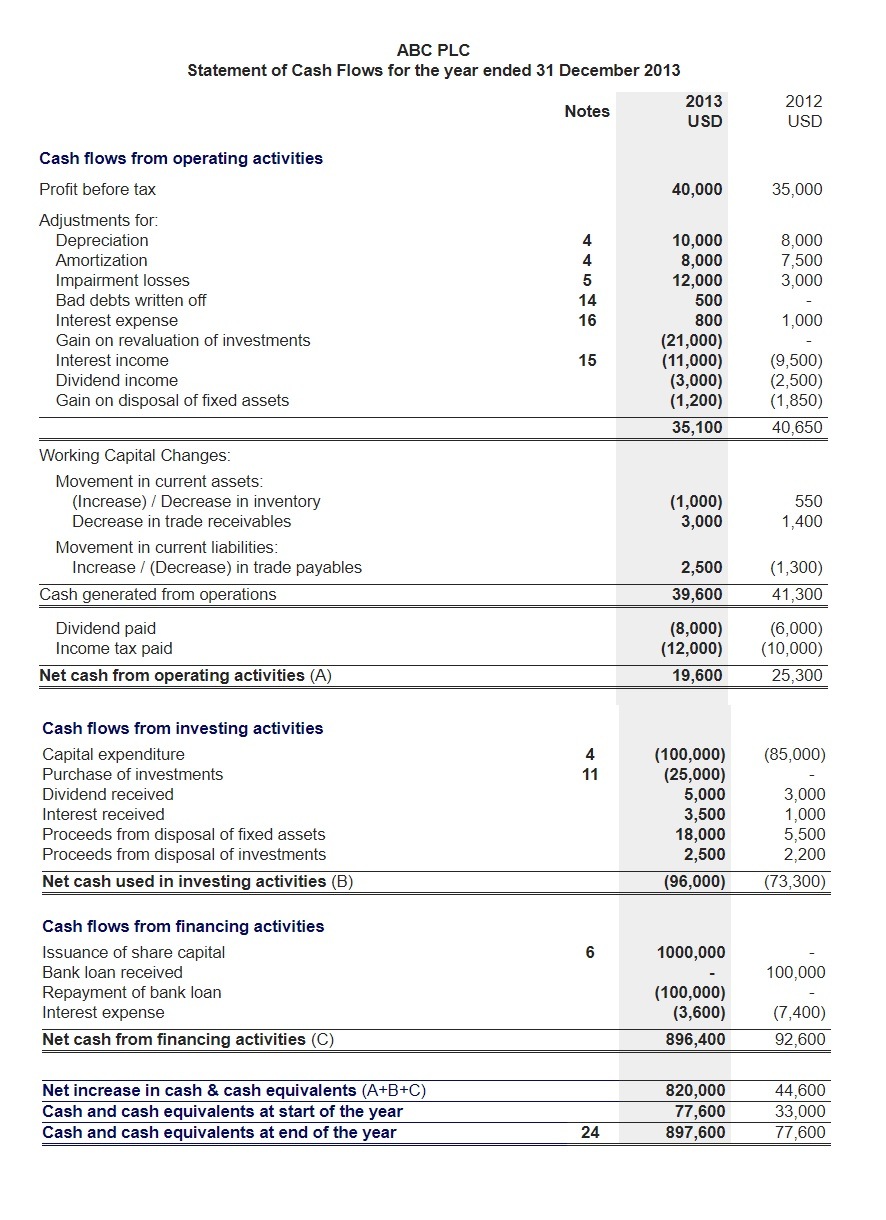

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. One item to remember when looking at the balance sheet and marketable securities. All the line items listed on the balance sheet always appear in order of liquidity.

Marketable securities held by the target company can significantly impact its valuation, as they represent liquid assets that can be quickly converted to cash. Additionally, the presence of high-quality, low-risk marketable securities can make a target company more attractive, as these assets enhance liquidity and reduce financial risk. Properly accounting for these securities ensures that the acquisition price reflects the true value of the target company, facilitating smoother negotiations and integration.

For non-finance professionals, understanding the concepts behind a cash flow statement and other financial documents can be challenging. In financial modeling, it’s critical to have a solid understanding of how to build the investing section of the cash flow statement. The main component is usually CapEx, but there can also be acquisitions of other businesses. There is a direct correlation between an insurance company’s assets and its income, as evidenced by the Prudential income statement and balance sheet. Investing in complex financial companies such as insurance companies requires understanding the business and the different jargon and layout of financial statements.

Where marketable securities are highly liquid and easily converted into cash, non-marketable securities are the exact opposite. For 2021, Airbnb had USD $6,067,438 in cash and cash equivalents, $2,255,038 in marketable securities, and its total current liabilities were $6,359,282. Marketable securities are short-term assets that can easily be converted into cash, as they are simple to buy or sell and generally mature quickly.

- It is part of a figure that helps determine how liquid a company is, its ability to pay expenses, or pay down debt if it needs to liquidate assets into cash to do so.

- Marketable securities play a significant role in portfolio management, offering a blend of liquidity, diversification, and risk management.

- Marketable securities are useful assets for a company to have if they need to raise funds quickly, such as for an acquisition opportunity or to meet a short-term obligation.

- Bankers’ acceptances are frequently used to facilitate transactions where there is little risk for either party.

- In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included because it is a business activity.

- Most companies earn most of their income from their core business, as Microsoft earns most of its income from computer hardware, cloud services, and other assorted products.

However, the indirect method also provides a means of reconciling items on the balance sheet to the net income on the income statement. As an accountant prepares the CFS using the indirect method, they can identify increases and decreases in the balance sheet that are the result of non-cash transactions. As for the balance sheet, the net cash flow reported on the CFS should equal the net change in the various line items reported on the balance sheet.

This method is commonly used for securities that are actively traded in public markets, such as stocks and bonds. Changes in fair value are recognized in the financial statements, either through profit or loss or other comprehensive income, depending on the classification of the security. For example, trading securities are measured at fair value with changes recognized in profit or loss, while available-for-sale securities have changes recognized in other comprehensive income. The fair value method provides a transparent view of the current market conditions but can introduce volatility into financial statements due to market fluctuations. An item on the cash flow statement belongs in the investing activities section if it is the result of any gains (or losses) from investments in financial markets and operating subsidiaries. An investing activity also refers to cash spent on investments in capital assets such as property, plant, and equipment, which is collectively referred to as capital expenditure, or CAPEX.

Cash-out transactions in CFF happen when dividends are paid, while cash-in transactions occur when the capital is raised. Prudential lists on the income statement as net investment income, such as below. Any dividends or sales of those marketable what gamestop gains and losses mean for your taxes equities contribute to those companies bottom lines. Most companies earn most of their income from their core business, as Microsoft earns most of its income from computer hardware, cloud services, and other assorted products.

A cash flow statement is a valuable measure of strength, profitability, and the long-term future outlook of a company. The CFS can help determine whether a company has enough liquidity or cash to pay its expenses. A company can use a CFS to predict future cash flow, which helps with budgeting matters. Analyzing changes in cash flow from one period to the next gives the investor a better idea of how the company is performing, and whether a company may be on the brink of bankruptcy or success. The CFS should also be considered in unison with the other two financial statements (see below). Like people, companies should maintain enough easily accessible cash to handle unexpected costs that might arise, for instance, when business is slow or the economy stumbles.