Accrued revenues are revenues that have been recognized (that is, services have been performed or goods have been delivered), but their cash payment have not yet been recorded or received. Let’s say a company has five salaried employees, each earning$2,500 per month. In our example, assume that they do not get paidfor this work until the first of the next month.

What Are the Types of Adjusting Journal Entries?

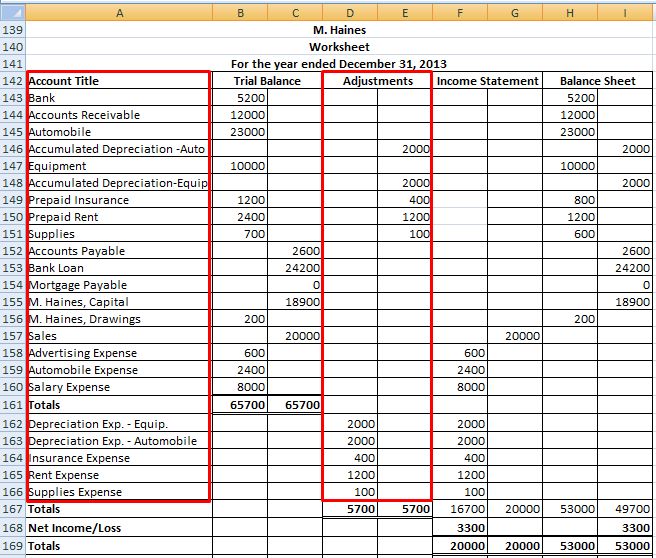

Adjustment entries are an important part of the accounting process that ensures financial statements are accurate and reflect the true financial position of a company. These entries are made at the end of an accounting period to update accounts that were not properly recorded during the period. Prepaid insurance is insurance that has been paid for but not yet used. To record prepaid insurance, an adjusting entry is made to decrease the asset account and increase the corresponding expense account. It is important to note that adjustment entries are not recorded in real-time and are typically made at the end of an accounting period.

Accounting 101: Adjusting Journal Entries

Similarly, if a company has incurred an expense that has not yet been recognized, an adjustment entry is made to include this expense in the income statement. At the end of an accounting period during which an asset is depreciated, the total accumulated depreciation amount changes on your balance sheet. And each time you pay depreciation, it shows up as an expense on your income statement. Unpaid expenses are those expenses that are incurred during a period but no cash payment is made for them during that period. Such expenses are recorded by making an adjusting entry at the end of the accounting period.

Accrued expenses

Not all journal entries recorded at the end of an accounting period are adjusting entries. For example, an entry to record a purchase of equipment on the last day of an accounting period is not an adjusting entry. If adjusting entries are not prepared, some income, expense, asset, and liability accounts may not reflect their true values when reported in the financial statements.

- For example, if a company has received payment for services that it has not yet provided, an adjustment entry is needed to record the revenue earned but not yet received.

- During the accounting period, the office supplies are used up and as they are used they become an expense.

- Adjusting entries, also called adjusting journal entries, are journal entries made at the end of a period to correct accounts before financial statements are made.

- Considering the amount of cash and tax liability on the line, it’s smart to consult with your accountant before recording any depreciation on the books.

What are the main purposes of accounting?

Having adjusting entries doesn’t necessarily mean there is something wrong with your bookkeeping practices. Depreciation and amortization are common accounting adjustments for small businesses. You can earn our Adjusting Entries Certificate of Achievement when you join PRO Plus. To help you master this topic and earn your certificate, you will also receive lifetime access to our premium adjusting entries materials. These include our visual tutorial, flashcards, cheat sheet, quick tests, quick test with coaching, and more. The most common method used to adjust non-cash expenses in business is depreciation.

( . Adjusting entries for accruing uncollected revenue:

At the end of the accounting period, you may not be reporting expenses that happen in the previous month. For example, say you need to hire a freelancer to help you at the end of February. That skews your actual expenses because the work was contracted and completed in February. Likewise, payroll expenses are often out of sync with your business accounting ledger until afterward.

This is extremely helpful in keeping track of your receivables and payables, as well as identifying the exact profit and loss of the business at the end of the fiscal year. The adjusting entry in this case is made to convert the receivable into revenue. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for helping your child start a business legally those states in which 11 Financial maintains a registration filing. The primary objective of accounting is to provide information that will help management take better decisions and plan for the future. It also helps users (lenders, employees and other stakeholders) to assess a business’s financial performance, financial position and ability to generate future Cash Flows.

To make an adjusting entry, you don’t literally go back and change a journal entry—there’s no eraser or delete key involved. Keep in mind, this calculation and entry will not match what your accountant calculates for depreciation for tax purposes. But this entry will let you see your true expenses for management purposes. The Vehicles account is a fixed asset account on your balance sheet. We post the purchase in this manner because you don’t fully deplete the usefulness of the truck when you purchase it.

To record accumulated depreciation, an adjusting entry is made to increase the accumulated depreciation account and decrease the corresponding asset account. To begin, the bookkeeper or accountant must identify the need for an adjustment entry. This could be due to an error in the original journal entry, the need to accrue expenses or revenue, or the need to record depreciation. So, your income and expenses won’t match up, and you won’t be able to accurately track revenue. Your financial statements will be inaccurate—which is bad news, since you need financial statements to make informed business decisions and accurately file taxes. Let’s say you pay your business insurance for the next 12 months in December of each year.

Therefore, it is necessary to find out the transactions relating to the current accounting period that have not been recorded so far or which have been entered but incompletely or incorrectly. An adjusting entry is an entry that brings the balance of an account up to date. Adjusting entries are crucial to ensure the correct balance and correct information in an account at the end of an accounting period.