Using the above payroll example, let’s say as of Dec. 31 your employees had earned wages totaling $8,750 for the period from Dec. 15 through Dec. 31. They didn’t receive these wages until Jan. 1, because you pay your employees on the 1st and 15th of each month. Other methods that non-cash expenses can be adjusted through include amortization, depletion, stock-based compensation, etc. An adjustment involves making a correct record of a transaction that has not been recorded or that has been entered in an incomplete or wrong way. If the Final Accounts are to be prepared correctly, these must be dealt with properly.

Mistake: Incorrect Accounting Entries

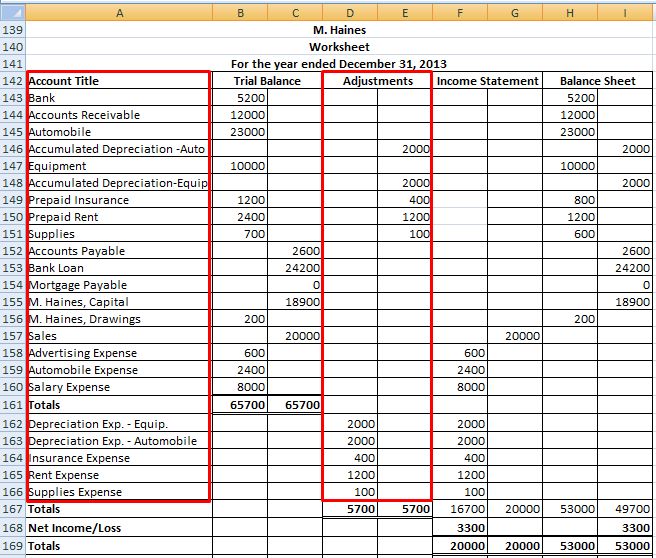

Adjustment entries are an important tool for businesses to ensure that their financial statements are accurate. These entries can impact a business’s cash flow, profitability, stock-based compensation, accounting periods, and fiscal year. Allowance for doubtful accounts is an estimate of the amount of accounts receivable that may not be collected. To record the allowance for doubtful accounts, an adjusting entry is made to increase the allowance for doubtful accounts expense account and decrease the corresponding asset account. In the balance sheet, adjustment entries are used to update the values of assets and liabilities. For example, if a company has an account receivable that is unlikely to be collected, an adjustment entry is made to reduce the value of the asset.

Composition of an Adjusting Entry

However, the company still needs to accrue interest expenses for the months of December, January, and February. Expenses should be recognized in the period when the revenues generated by such expenses are recognized. The accrual concept states that income is recognized when earned regardless of when collected and expense is recognized when incurred regardless of when paid.

What are the main purposes of accounting?

- Net income and the owner’s equity will be overstated, while expenses and liabilities understated.

- Press Post and watch your fixed assets automatically depreciate and adjust on their own.

- Understanding adjustment entries is critical for anyone involved in accounting, finance, or business operations.

- The same principles we discuss in the previous point apply to revenue too.

- First, record the income on the books for January as deferred revenue.

Companies that use accrual accounting and find themselves in a position where one accounting period transitions to the next must see if any open transactions exist. The purpose of adjusting entries is to convert cash transactions into the accrual accounting method. Accrual accounting is based on the revenue recognition principle that seeks to recognize revenue in the period when it was earned, rather than the period when cash is received.

Depreciation Expense

This article will take a close look at adjusting entries for accounting purposes, how they are made, what they affect and how to minimize their impact on your financial statements. Usually financial statements refer to the balance sheet, income statement, statement of cash flows, statement of retained earnings, and statement of stockholders’ equity. That’s why most companies use cloud accounting software to streamline their adjusting entries and other financial transactions.

Part 2: Your Current Nest Egg

Some common examples of prepaidexpenses are supplies, depreciation, insurance, and rent. When a company purchases supplies, the original order, receiptof the supplies, and receipt of the invoice from the vendor willall trigger journal entries. This trigger does not occur when usingsupplies from the supply closet.

The following are the updated ledger balances afterposting the adjusting entry. Income Tax Expense increases (debit) and Income Tax Payableincreases (credit) for $9,000. The following are the updated ledgerbalances after posting the adjusting entry. Interest Expense increases (debit) and Interest Payableincreases (credit) for $300. Interest Receivable increases (debit) for $1,250 becauseinterest has not yet been paid.

In accounting, adjusting entries are journal entries usually made at the end of an accounting period to allocate income and expenditure to the period in which they actually occurred. The revenue recognition principle is the basis of making adjusting entries that pertain to unearned and accrued revenues under accrual-basis accounting. They are sometimes called Balance Day adjustments because they are made on balance day. Recording transactions in your accounting software isn’t always enough to keep your records accurate.

For example, a company performs landscaping services in theamount of $1,500. Atthe period end, the company would record the following adjustingentry. During theyear, it collected retainer fees totaling $48,000 from clients.Retainer fees are money lawyers collect in advance of starting workon a case. When the company collects this money from its clients,it will debit cash and credit unearned fees.

And we offset that by creating an increase to an asset account — Prepaid Expenses — for the same amount. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). For the company’s December income statement to accurately report the company’s profitability, it must include all of the company’s December expenses—not just the expenses that were paid. Similarly, for the company’s balance sheet on December 31 to be accurate, it must report a liability for the interest owed as of the balance sheet date.

We prefer to see it as an operating expense so it doesn’t skew your gross profit margin. The Reserve for Inventory Loss account is a contra asset account, and it shows up under your Inventory asset account on your balance sheet as a negative number. Using the business insurance example, you paid $1,200 for next year’s coverage keep ghosts off the payroll on Dec. 17 of the previous year. If you are a cash basis taxpayer, this payment would reduce your taxable income for the previous year by $1,200. Or perhaps a customer has made a deposit for services you have not yet rendered. Most accruals will be posted automatically in the course of your accrual basis accounting.